Time Deposit Account

- Time Deposit Accounts Are Investment Accounts In Nature

- Time Deposit Account Withdrawal

- Time Deposit Accounts Are

- Time Deposit Rates

- Time Deposit Account Means

- Time Deposit Account In The Philippines

The PBCOM Sure Earner is a time deposit account with a low initial deposit of ₱50,000 that can already earn an above-average interest rate of 2.50% locked in for at least 5 years and 1 day. A certificate of deposit is issued as proof. The BANK may close an account any time without prior notice to the Depositor, if the deposit balance becomes zero, due to collection of service charges by the BANK or withdrawal by the Depositor, or for violation of existing rules and regulations of the BANK, the Bangko Sentral ng Pilipinas, Anti-Money Laundering Council, Bankers’ Association. In fact, Marcus guarantees that you'll receive the highest rate it offers on a CD within 10 days of opening an account, as long as you deposit $500 during that time.

A time deposit or TD is a type of investment account, similar to a savings account, where you keep your savings for a set amount of time without withdrawing it. It has higher interest rates than a regular savings account and is considered “risk-free.” Expect higher earnings via interest the longer you keep your time deposit in the bank. If you allow your account balance to drop to one cent or below, your account will be suspended, and you will be unable to access any fee-based features within the Services. Account access will be restored once you make a deposit, or authorize charges against a valid credit card. You may associate up to two credit cards to your account.

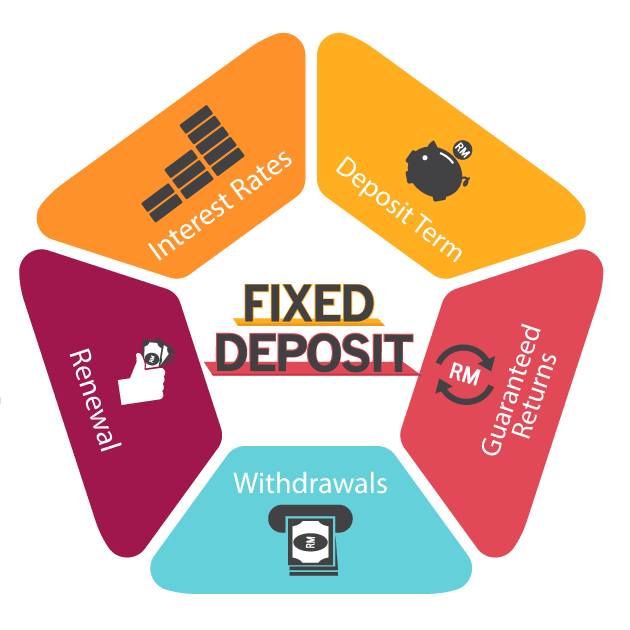

A time deposit or term deposit (in the United States also known as a certificate of deposit) is a deposit in a financial institution with a specific maturity date or a period to maturity, commonly referred to as its “term”. Time deposits differ from at call deposits, such as savings or checking accounts, which can be withdrawn at any time, without any notice or penalty. Deposits that require notice of withdrawal to be given are effectively time deposits, though they do not have a fixed maturity date.

Unlike a certificate of deposit and bonds, a time deposit is generally not negotiable; it is not transferable by the depositor, so that depositors need to deal with the financial institution when they need to prematurely cash out of the deposit.

Time deposits enable the bank to invest the funds in higher-earning financial products. In some countries, including the United States, time deposits are not subject to the banks’ reserve requirements, on the basis that the funds cannot be withdrawn at short notice. In some countries, time deposits are guaranteed by the government or protected by deposit insurance.

Interest[edit]

Time deposits normally earn interest, which is normally fixed for the duration of the term and payable upon maturity, though some may be paid periodically during the term, especially with longer-term deposits. Generally, the longer the term and the larger the deposit amount the higher the interest rate that will be offered.[1]

Time Deposit Accounts Are Investment Accounts In Nature

The interest paid on a time deposit tends to be higher than on an at-call savings account, but tends to be lower than that of riskier products such as stocks or bonds. Some banks offer market-linked time deposit accounts which offer potentially higher returns while guaranteeing principal.

At maturity[edit]

At maturity, the principal can be either paid back to the depositor (usually by a deposit into a bank account designated by the depositor) or rolled over for another term. Interest may be paid into the same account as the principal or to another bank account or rolled over with the principal to the next term.

The money deposited normally can be withdrawn before maturity, but a significant penalty will normally be payable.

See also[edit]

Time Deposit Account Withdrawal

References[edit]

- ^'Time Deposit'. Investopedia. 2003-11-24. Retrieved 2016-11-01.

Time Deposit Accounts Are

A deposit alternative for members whose Capital Contribution Account has already reached the maximum limit.

Eligibility:

- Open to Regular and Associate members with existing SD-002 Account where he/she is the principal depositor

Time Deposit Rates

- Minimum deposit of ₱15,000

- Deposit anytime (no placement period)

- Interest earned shall be posted semi-annually. Principal and remaining interest shall be posted to SD-02 account upon maturity.

- Documentary Stamp Tax (DST) to be shouldered by AFPSLAI

- Duly filled-out TD Account Form and TD Agreement

- AFPSLAI ID

- SD-002 passbook

- Proof of sources of funds

Time Deposit Account Means

Other terms and conditions:

Time Deposit Account In The Philippines

- Single account only. No co-depositors allowed.

- Deposits must not come from other savings accounts of the member or his family group.

- Members can pre-terminate his/her TD, subject to

- Pre-termination rate

At least half of the term 50% of the interest rate. Less than half of the year 25% of the interest rate. - DST shall be deducted in full from the pre-termination proceeds.

- Proceeds of the pre-termination shall be posted to member’s SD-002 account.

- The TD Agreement must be surrendered to AFPSLAI where the TD was originally opened.

- Pre-termination rate