Deposit Rate

Savings Accounts

Deposit Interest Calculator. Calculate how your savings can grow: The Deposit Interest Calculator computes initial deposit, interest rate, maturity or final amount – with or without consideration of compound interest. 1 - Select the item you'd like to solve for. 2 - Fill out the white input boxes. 3 - Click on 'Calculate'. .Interest calculation for the 3, 5, 6, 8 and 9-month certificates of deposit is based upon simple interest. All other certificates of deposit products are compounded daily.Easy Access CD, minimum daily. Revision of interest rate on Term Deposits w.e.f. The interest rate applicable for “Deposit/s of above ₹ 5 crore” and approval for acceptance of such deposit/s shall be obtained from Treasury Branch. This condition is also applicable to cases where the aggregate value of deposits.

Savings Account

| Minimum Balance | Rate | APY |

|---|---|---|

| $5.00 | .10% | .10% |

Individual Retirement Account (IRA) Savings

| Minimum Balance | Rate | APY |

|---|---|---|

| $5.00 | .10% | .10% |

Christmas Club Account

| Minimum Balance | Rate | APY |

|---|---|---|

| $0 | .10% | .10% |

Vacation Club Account

| Minimum Balance | Rate | APY |

|---|---|---|

| $0 | .10% | .10% |

Certificates

Certificates

| Term | Minimum Balance | Rate | APY |

|---|---|---|---|

| 6 - Month Certificate | $500 | .39% | .40% |

| 1 - Year Certificate | $500 | .59% | .60% |

| 2 - Year Certificate | $500 | .69% | .70% |

| 3 - Year Certificate | $500 | .74% | .75% |

| 5 - Year Certificate | $500 | .89% | .90% |

| 1 - Year Jumbo Certificate | $100,000 | .64% | .65% |

| 2 - Year Jumbo Certificate | $100,000 | .74% | .75% |

IRA Certificates

| Term | Minimum Balance | Rate | APY |

|---|---|---|---|

| 6 - Month Certificate | $500 | .39% | .40% |

| 1 - Year Certificate | $500 | .59% | .60% |

| 2 - Year Certificate | $500 | .69% | .70% |

| 3 - Year Certificate | $500 | .74% | .75% |

| 5 - Year Certificate | $500 | .89% | .90% |

| 1 - Year Jumbo Certificate | $100,000 | .64% | .65% |

| 2 - Year Jumbo Certificate | $100,000 | .74% | .75% |

Health Savings Account (HSA) Certificates

| Term | Minimum Balance | Rate | APY |

|---|---|---|---|

| 6 - Month Certificate | $500 | .39% | .40% |

| 1 - Year Certificate | $500 | .59% | .60% |

| 2 - Year Certificate | $500 | .69% | .70% |

| 3 - Year Certificate | $500 | .74% | .75% |

Money Market Accounts

Thrive Money Market

| Deposit Amount | Rate | APY |

|---|---|---|

| $100 - $4,999.99 | .14% | .15% |

| $5,000 - $24,999.99 | .29% | .30% |

| $25,000+ | .49% | .50% |

IRA Money Market

| Deposit Amount | Rate | APY |

|---|---|---|

| $100 - $4,999.99 | .14% | .15% |

| $5,000 - $24,999.99 | .29% | .30% |

| $25,000+ | .49% | .50% |

Checking Accounts

Choice Checking

| Deposit Amount | Rate | APY |

|---|---|---|

| Up to $4,999.99 | .05% | .05% |

| $5,000+ | .10% | .10% |

Amplified High-Yield Checking*

Bankrate Cd Rates

| Deposit Amount | Rate | APY |

|---|---|---|

| Up to $1,499.99 | .05% | .05% |

| $1,500 - $49,999.99 | .20% | .20% |

| $50,000 - $249,999.99 | .69% | .70% |

| $250,000 - $999,999.99 (br) (Variable based on 1-Month Treasury Bill) | .69% | .70% |

| $1,000,000+ (br) (Variable based on 1-Month Treasury Bill) | .69% | .70% |

HSA Checking Account

| Deposit Amount | Rate | APY |

|---|---|---|

| $0 | .10% | .10% |

APY = Annual Percentage Yield. Rates are subject to change. Please call: 513.243.4328 or 800.542.7093 with questions. Disclosures are available upon request.

*Amplified High-Yield Checking: If your average daily balance is below $1,500, you will incur a $15 monthly maintenance fee. To earn dividends, you must have a balance greater than $0. Dividend rates are based on the account balance and account tier. The tiers are as follows: Tier 1 daily balance of $0.01 to $1,499.99; Tier 2 daily balance of $1,500 to $49,999.99; Tier 3 daily balance of $50,000 to $249,999.99; Tier 4 daily balance of $250,000 to $999,999.99 (1-Month Treasury Bill); Tier 5 daily balance of 1,000,000 or more (1-Month Treasury Bill). Tiers 4 and 5 are subject to variable-rate pricing and will adjust weekly. Under no circumstance will Tier 4 and Tier 5 rates be less than the stated Tier 3 rate. We will update this rate weekly on Tuesday to reflect the previous Friday’s 1-Month Treasury Bill rate. If the preceding Friday, Monday, or Tuesday are an observed holiday, the rates will be updated the following Wednesday. The 1-Month Treasury Bill rate can be found from the U.S. Department of Treasury site under the “Daily Treasury Yield Curve Rate” drop down option. We use the daily balance method to calculate the dividend on your account. Dividends begin to accrue no later than the business day we receive the deposit to your account. You will receive the accrued dividends if you close your account before dividends are posted. Annual Percentage Yield will vary due to account activity and balance. Fees may reduce earnings.

Back to Top

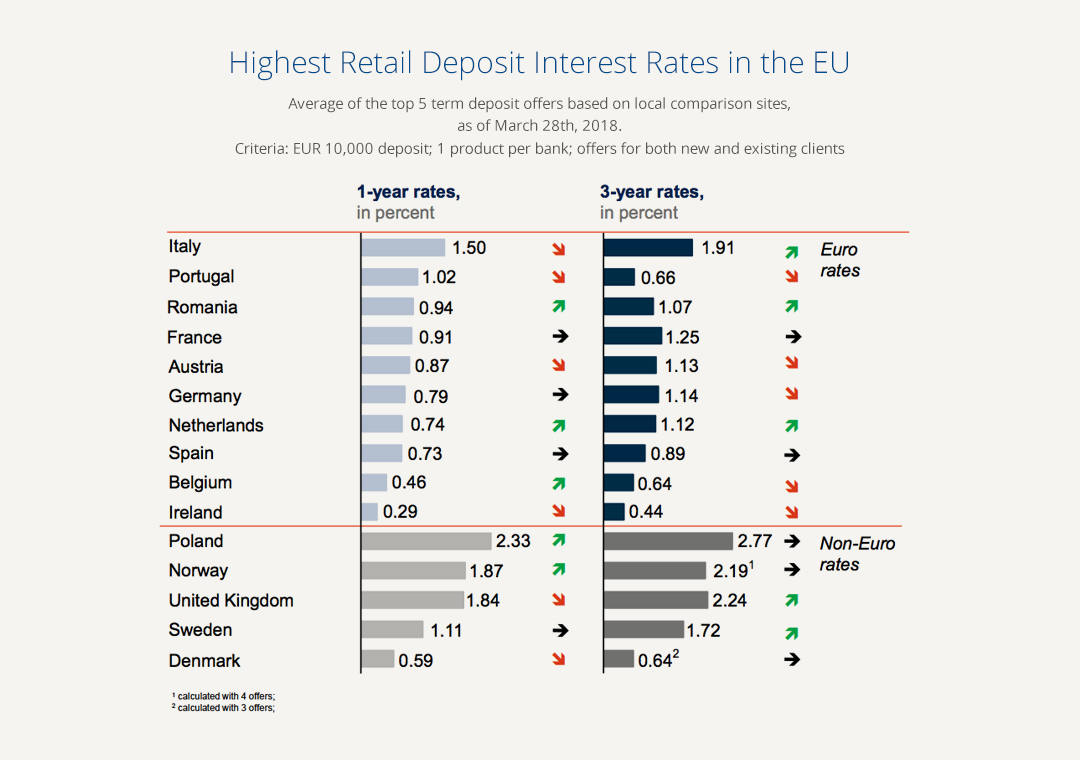

Deposit Rate In India

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Open a Chase Certificate of Deposit

You must be an existing Chase checking customer to open online.

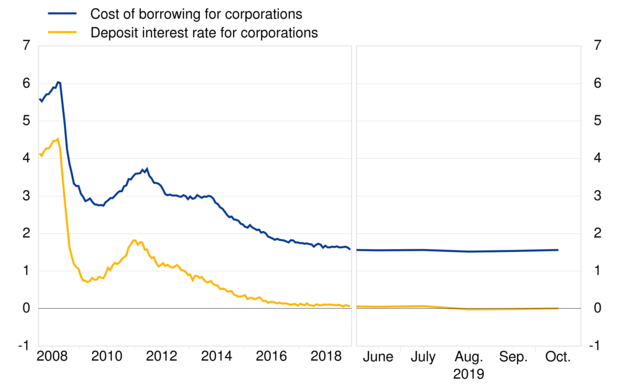

Deposit Rate Ecb

Certificate of Deposit FAQ

What is a Chase CD?

A certificate of deposit, or CD, is a deposit account with us for a specified period of time.

What is the minimum deposit amount to open a Chase CD?

$1,000

How is the Chase CD interest calculated?

We use the daily balance method to calculate interest on your CD. This method applies a periodic rate each day to your balance. Interest begins to accrue on the business day of your deposit. Interest for CDs is calculated on a 365-day basis, although some business CDs may calculate interest on a 360-day basis. The Annual Percentage Yield (APY) disclosed on your deposit receipt or on the maturity notice assumes interest will remain on deposit until maturity. On maturities of more than one year, interest will be paid at least annually. Please see the Deposit Account Agreement and rate sheet for further details.

Are there early withdrawal fees or penalties associated with a Chase CD?

There is a penalty for withdrawing principal prior to the maturity date. For Personal CDs:

- If the term of the CD is less than 6 months, the early withdrawal penalty is 90 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the term of the CD is 6 months to less than 24 months, then the early withdrawal penalty is 180 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- For terms 24 months or more, the early withdrawal penalty is 365 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the withdrawal occurs less than seven days after opening the CD or making another withdrawal of principal, the early withdrawal penalty will be calculated as described above, but it cannot be less than seven days’ interest.

- The amount of your penalty will be deducted from principal.

See the Deposit Account Agreement and rate sheet for further details

What does it mean when my Chase CD matures?

The maturity date is the last day of your CD’s term. The grace period begins the following day and lasts for 10 days – this is when you can make changes to your CD. Go to chase.com/cdmaturity to learn more about what options you have when your CD matures.

Find a Chase ATM or branch

To find a Chase ATM or branch near you, tell us a ZIP code or an address.

Open a Chase Certificate of Deposit

You must be an existing Chase checking customer to open online.

Certificate of Deposit FAQ

What is a Chase CD?

A certificate of deposit, or CD, is a deposit account with us for a specified period of time.

What is the minimum deposit amount to open a Chase CD?

$1,000

How is the Chase CD interest calculated?

We use the daily balance method to calculate interest on your CD. This method applies a periodic rate each day to your balance. Interest begins to accrue on the business day of your deposit. Interest for CDs is calculated on a 365-day basis, although some business CDs may calculate interest on a 360-day basis. The Annual Percentage Yield (APY) disclosed on your deposit receipt or on the maturity notice assumes interest will remain on deposit until maturity. On maturities of more than one year, interest will be paid at least annually. Please see the Deposit Account Agreement and rate sheet for further details.

Are there early withdrawal fees or penalties associated with a Chase CD?

There is a penalty for withdrawing principal prior to the maturity date. For Personal CDs:

- If the term of the CD is less than 6 months, the early withdrawal penalty is 90 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the term of the CD is 6 months to less than 24 months, then the early withdrawal penalty is 180 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- For terms 24 months or more, the early withdrawal penalty is 365 days of interest on the amount withdrawn, but not more than the total amount of interest earned during the current term of the CD.

- If the withdrawal occurs less than seven days after opening the CD or making another withdrawal of principal, the early withdrawal penalty will be calculated as described above, but it cannot be less than seven days’ interest.

- The amount of your penalty will be deducted from principal.

See the Deposit Account Agreement and rate sheet for further details

What does it mean when my Chase CD matures?

The maturity date is the last day of your CD’s term. The grace period begins the following day and lasts for 10 days – this is when you can make changes to your CD. Go to chase.com/cdmaturity to learn more about what options you have when your CD matures.

Find a Chase ATM or branch

To find a Chase ATM or branch near you, tell us a ZIP code or an address.